Our country India is an agricultural country. Major population of India about 58% are involved in agriculture. The primary source of their livelihood is agriculture only.

The farmers of our country depend on agriculture for their livelihood. They work very hard to get a good yield of the crop so that they can earn money by selling it in the market. Farming is entirely dependent on the weather. Weather plays an important role in producing good crops. But unfortunately, we cannot control the weather. Due to bad weather like extreme hot, extreme cold, heavy rain and other natural calamity farmer crops get spoiled due to which they have to suffer a lot.

Keeping these facts in mind Pradhan Mantri Fasal Bima Yojana (PMFBY) was launched by the Indian Government. Through this scheme, farmers will be able to compensate for the loss of their crops. At the time of sowing the crop, the farmers will have to pay some amount as insurance. The benefit of this will be, if the crop of the farmers gets damaged due to natural calamity, they will be given an insurance claim to recover the loss.

What is Pradhan Mantri Fasal Bima Yojana (PMFBY)

The Pradhan Mantri Fasal Bima Yojana (PMFBY) was launched on 18 February 2016 by Prime Minister Narendra Modi. This scheme is an insurance service for farmers for their yields. PMFBY aims to provide a comprehensive insurance cover against failure of the crop thus helping in stabilizing the income of the farmers.

PMFBY was formulated in line with the One Nation–One Scheme theme by replacing the earlier two schemes National Agricultural Insurance Scheme (NAIS) and Modified National Agricultural Insurance Scheme (MNAIS) by incorporating their best features and removing their inherent drawbacks (shortcomings). It aims to reduce the premium burden on farmers and ensure early settlement of crop assurance claims for the full insured sum.

The scheme is implemented by impaneled general insurance companies. The scheme was earlier compulsory for loanee farmers availing Crop Loan / KCC account for notified crops and voluntary for others but it has been made voluntary since 2020 when reforms in the scheme were introduced. The scheme is being administered by the Ministry of Agriculture and Farmers Welfare.

Under Pradhan Mantri Fasal Bima Yojana, farmers are paid a fixed, 2% premium for Kharif crops and 1.5% premium for Rabi crops by insurance companies. This scheme provides protection not only for Kharif and Rabi crops but also for Commercial and Horticulture crops, for annual commercial and horticulture crops farmers have to pay 5% premium (installment).

In this, the insurance premiums to be paid by farmers against crop damage due to natural calamities have been kept very low, which can be easily paid by every level of the farmer.

Revamped Pradhan Mantri Fasal Bima Yojana (PMFBY)

- Enrolment has been made voluntary for all the farmers. Earlier, the loanee farmers were covered compulsorily, but now the farmers may join the scheme as per his/her willingness.

- The existing loanee farmers who do not desire to be enrolled under the scheme have the choice to Opt Out of the scheme by submitting a self-declaration in writing to a serving bank branch anytime during the year but at least 7 days before the cut-off date for enrolment for the respective season.

- If the loanee farmer does not submit any self-declaration in the bank, the premium amount for the notified crops will be deducted by the bank from his account.

- All Savings or Jan Dhan Account holding farmers may also participate in the scheme by enrolling through their respective bank branches.

- There is no change in the premium rates payable by the farmers. It remains applicable at 2.0% for Kharif crops, 1.5% for Rabi crops and 5% for horticultural and commercial crops.

Objective Of PMFBY

- Providing financial support to farmers suffering crop loss/damage arising out of unforeseen events.

- Stabilizing the income of farmers to ensure their continuance in farming.

- Encouraging farmers to adopt innovative and modern agricultural practices.

Coverage of Farmers Under PMFBY

All the farmers growing notified crops in a notified area during the season who have insurable in the crop are eligible.

Coverage of Crops Under PMFBY

- Oil Seeds

- Food Crops

- Annual Commercial / Annual Horticultural Crops.

Coverage of Risk Under PMFBY

- Prevented Sowing/Planting/Germination Risk: The insured area is prevented from sowing/planting/germination due to deficit rainfall or adverse seasonal/weather conditions.

- Standing Crop (Sowing to Harvesting): Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, viz. Drought, Dry Spells, Floods, Inundation, Widespread Pests and Disease Attacks, Landslides, Fire Due to Natural Causes, Lightning, Storm, Hailstorm and Cyclone.

- Post-Harvest Losses: Coverage is available only up to a maximum period of two weeks from harvesting, for those crops which are required to be dried in cut and spread/small bundled condition in the field after harvesting against specific perils of Hailstorm, Cyclone, Cyclonic Rains and Unseasonal Rains.

- Localized Calamities: Loss/damage to notified insured crops resulting from the occurrence of identified localized risks of Hailstorm, Landslide, Inundation, Cloud Burst and Natural Fire due to lightning affecting isolated farms in the notified area.

- Add-on coverage for crop loss due to attack by wild animals: The States may consider providing add-on coverage for crop loss due to attack by wild animals wherever the risk is perceived to be substantial and identifiable.

Exclusions of Risks Under PMFBY

Losses/Damages arising out of War and Nuclear Risks, Malicious Damage and Other Preventable Risks shall be excluded.

List of Insurance Company Under PMFBY

The Department of Agriculture Cooperation & Farmers Welfare has designated/impaneled the Agriculture Insurance Company of India (AIC).

- Agriculture Insurance Company of India Ltd.

- ICICI Lombard General Insurance Company Ltd.

- HDFC ERGO General Insurance Company Ltd.

- IFFCO Tokio General Insurance Company Ltd.

- Cholamandalam MS General Insurance Company Ltd.

- Bajaj Allianz General Insurance Company Ltd.

- Reliance General Insurance Company Ltd.

- Future Generali India Insurance Company Ltd.

- Tata AIG General Insurance Company Ltd.

- SBI General Insurance Company Ltd.

- Universal Sompo General Insurance Company Ltd.

- Bharti Axa General Insurance Company Ltd.

- National Insurance Company Ltd.

- New India Assurance Company Ltd.

- Oriental Insurance Company Ltd.

- Royal Sundaram General Insurance Company Ltd.

- Shriram General Insurance Company Ltd.

- United India Insurance Company Ltd.

PMFBY Scheme Registration Dates

Farmers can apply for the PMFBY scheme two times a year. One for Kharif Season and the Second for Rabi Season.

| Seasons | Last Date for Apply |

| Kharif | 31st July |

| Rabi | 31st December |

Required Documents For PMFBY Scheme

In order to apply for the PMFBY scheme, the farmer has to arrange the below mentioned set of documents.

- Passport Size Photograph of the Farmer.

- Identity Proof of the Farmer (Aadhaar Card, Voter ID Card, PAN Card, Driving License, Passport).

- Address Proof of the Farmer (Aadhaar Card, Voter ID Card, Driving License, Passport).

- Khasra paper with number, if the field is owned by the farmer.

- If the farmer does farming in someone else’s field, then the certificate of agreement between the farmer and the owner of the field with Khasra number.

- Certificate of sowing in the field by Pradhan, Sarpanch, Gaon Pradhan, Patwari.

- Bank Passbook or Cancelled Cheque.

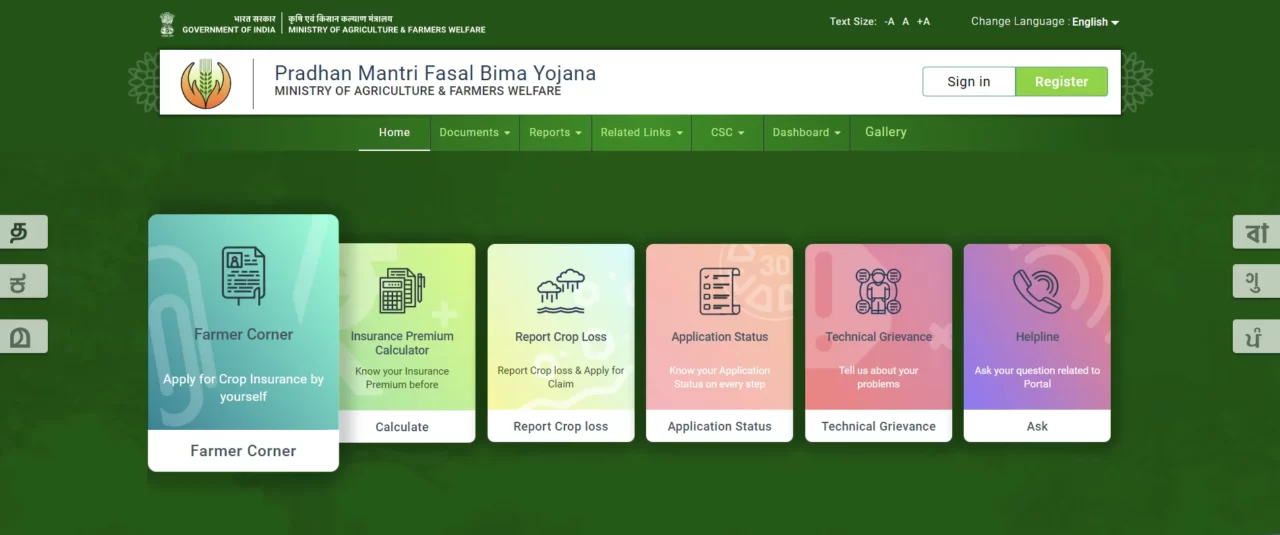

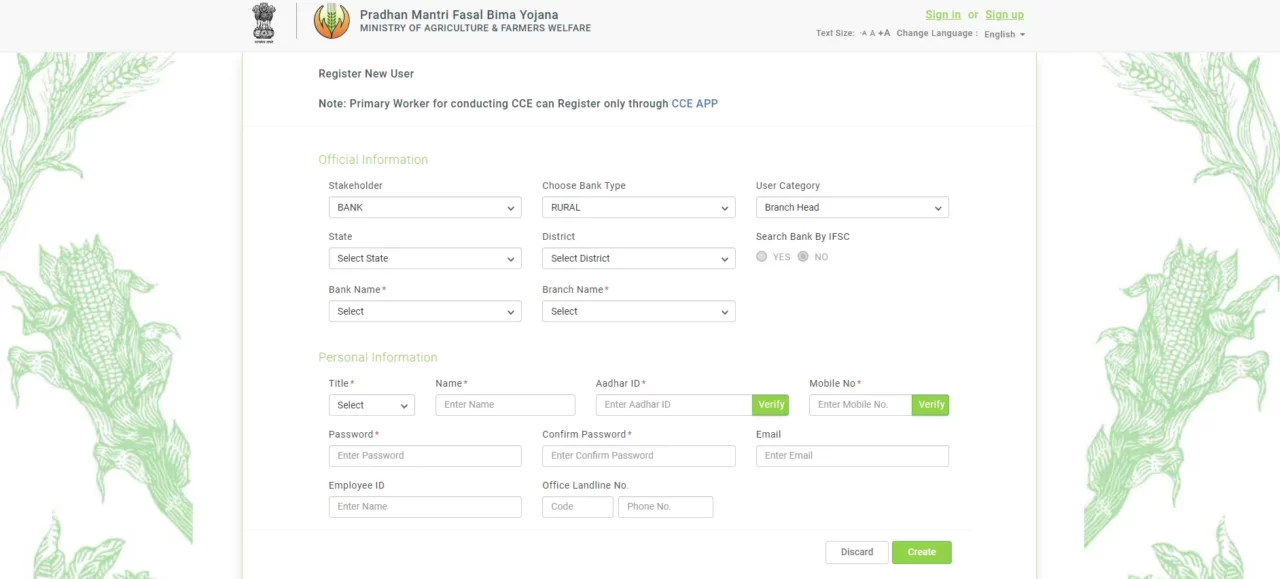

How to Complete Self Registration Online For PMFBY Scheme

The government is provided the facility to all Indian Farmers to Apply Online / Online Registration for Pradhan Mandti Fasal Bima Yojana (PMFBY) by themselves.

The steps for Applying Online are mentioned below:

- Visit the PMFBY portal https://pmfby.gov.in/

- Click on the ‘Register’ tab to register.

- Enter the Official and Personal Information as required.

- The user then needs to verify the Aadhar Number and the Mobile Number.

- After filling in and verifying all details, click on Create.

- Once the registration is approved, the approval/rejection will be notified to the user through an SMS or an email.

How to Enrol for PMFBY Scheme Through Bank

The farmers who have availed of the seasonal agriculture loan/KCC with the bank, get the option of Crop Insurance under the PMFBY Scheme through the bank.

Loanee farmers may reach out to the serving bank branches from where they have availed the seasonal agriculture loan/KCC with an application giving their consent to enroll themselves in the scheme for the notified crop sown/intent to sow.

Since the scheme is made voluntary, the existing loanee farmers who do not wish to be enrolled under the scheme have the choice to Opt Out of the scheme by submitting a self-declaration in writing to a serving bank branch (from where they have availed KCC or seasonal agriculture loan) anytime during the year but at least 7 days before the cut-off date for enrolment for the respective season.

If the loanee farmer does not submit any self-declaration in the bank, the premium amount for the notified crops will be deducted by the bank from his account.

Cut-Off Date for Enrollment under PMFBY

General enrolment cut-offs for the Kharif season and Rabi season are 15th – 31st July and 15th – 30th December respectively, but it may vary as per the crop calendar of the respective State. These dates should be verified from the notification issued by the State Government before the commencement of enrolment.

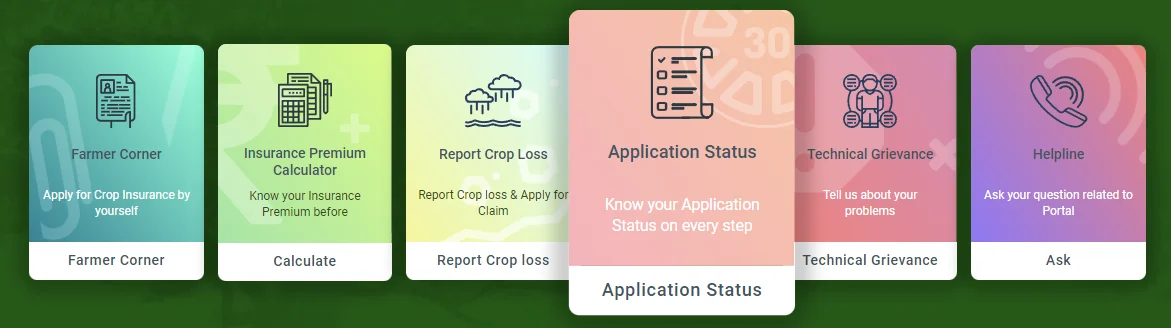

How to check PMFBY Application Status

The applicant farmers can track their Pradhan Mantri Fasal Bima Yojana (PMFBY) application status online.

Follow the below mentioned Steps to check the application status online:

- Visit the PMFBY portal https://pmfby.gov.in/

- Click on the Application Status icon.

- Fill in the required details like the Receipt Number and Captcha Code and then click on Check Status to proceed.

- Your application status will show there.

PMFBY Insurance Claim Calculator

PMFBY portal allows interested farmers to know their insurance premium before Crop Insurance using the “Insurance Premium Calculator”.

Steps to use the Insurance Premium Calculator are mentioned below:

- Visit the Official PMFBY website https://pmfby.gov.in/

- Click on the Insurance Premium Calculator icon.

- Fill in all the required details like Season, Year, Scheme, State, District and Crop, and then click on Calculate to proceed.

- The system will show the premium amount which the Farmer will have to pay if they opt for it.

How To Claim PMFBY Insurance Amount

The claim process of Pradhan Mantri Fasal Bima Yojana (PMFBY) is very easy and hassle-free. To claim the sum assured of PMFBY the following steps have to be followed.

- The insured farmer must intimate the loss details immediately within 72 hours of the calamity either to the insurance company/concerned bank/local agriculture department, or district officials.

- The intimation should have all the details insured farmer such as the name, affected survey number-wise crop insured and acreage affected.

- A Damage Surveyor will be appointed for the purpose by the insurance company within 72 hours of receiving the intimation.

- The appointed Damage Surveyor will inspect the agricultural site within the next 10 days.

- If it is found genuine, claim settlement/payment is to be made by the Insurance Company in the next 15 days to the eligible farmers.

PMFBY Report Crop Loss

If the crop is in distress, the farmer can report crop loss for the claim to their below-mentioned concerned insurance company on their mentioned Toll-Free Number and Email Id.

| Sl. No. | Insurance Company Name | Toll-Free Number | Headquater Email |

| 1 | Agriculture Insurance Company | 1800116515 | fasalbima@aicofindia.com |

| 2 | Bajaj Allianz General Insurance Co. Ltd | 18002095959 | bagichelp@bajajallianz.co.in |

| 3 | Bharti Axa General Insurance Company Ltd. | 18001037712 | customer.service@bharti-axagi.co.in |

| 4 | Cholamandalam Ms General Insurance Company Limited | 18002005544 | customercare@cholams.murugappa.com |

| 5 | Future Generali India Insurance Co. Ltd. | 18002664141 | fgcare@futuregenerali.in |

| 6 | Hdfc Ergo General Insurance Co. Ltd. | 18002660700 | pmfbycell@hdfcergo.com |

| 7 | Icici Lombard General Insurance Co. Ltd. | 18002669725 | customersupport@icicilombard.com |

| 8 | Iffco Tokio General Insurance Co. Ltd. | 18001035490 | supportagri@iffcotokio.co.in |

| 9 | National Insurance Company Limited | 18003450330 | customer.relations@nic.co.in |

| 10 | New India Assurance Company | 18002091415 | customercare.ho@newindia.co.in |

| 11 | Oriental Insurance | 1800118485 | crop.grievance@orientalinsurance.co.in |

| 12 | Reliance General Insurance Co. Ltd. | 18001024088 (For the Rest of India) / 18001802117 (For Haryana Only) | rgicl.pmfby@relianceada.com |

| 13 | Royal Sundaram General Insurance Co. Limited | 18005689999 | crop.services@royalsundaram.in |

| 14 | Sbi General Insurance | 180022111118001021111 | customer.care@sbigeneral.in |

| 15 | Shriram General Insurance Co. Ltd. | 180030030000 / 18001033009 | chd@shriramgi.com |

| 16 | Tata Aig General Insurance Co. Ltd. | 18002093536 | customersupport@tataaig.com |

| 17 | United India Insurance Co. | 180042533333 | customercare@uiic.co.in |

| 18 | Universal Sompo General Insurance Company | 18002005142 | contactus@universalsompo.com |

PMFBY Technical Grievance

If you have any complaints or grievances regarding the PMFBY portal you can file through the Technical Grievance feature.

Follow the below steps to file complaints or grievances:

- Visit the Official PMFBY website https://pmfby.gov.in/

- Click on the Technical Grievance icon.

- Fill in all the required details like Name, Mobile No. and Email Id. Write your complaint or issue in the Comments box.

- Enter Captcha Code and then click on Submit.

- Your complaint or grievance will submit.

PMFBY Helpline

If you need any help regarding Crop Insurance, you can write an email to help.agri-insurance@gov.in.

PMFBY Crop Insurance App

“Crop Insurance App” is an android-based app developed by the Ministry of Agriculture and Farmers Welfare, Government of India for facilitating Crop Loss Intimation during localized calamities and post-harvest losses. Farmers can also download this app from Google Play Store.

This app provides the following crop insurance services:

- Apply to PMFBY Scheme

- Download Crop Insurance Policy

- Know Your Insurance Premium

- Crop Loss Intimation and Status Report

- Track your Application Status

- Report Crop Loss

- Helpline Number

Conclusion

Pradhan Mantri Fasal Bima Yojana (PMFBY) is a very good step taken by the Government of India which helps the farmers to provide comprehensive insurance services for their yields and stabilize their income. The premium of insurance under this scheme has been kept very low so that the maximum number of farmers can take benefit from this scheme. Along with this, the online registration process has been kept very simple so that farmers can easily understand it and register themselves without any help.

PMFBY Frequently Asked Questions (FAQs)

Q: What is the full form of PMFBY?

Ans: Pradhan Mantri Fasal Bima Yojana.

Q: What is Pradhan Mantri Fasal Bima Yojana?

Ans: PMFBY scheme is an insurance service for farmers for their yields.

Q: Which crops are covered under PMFBY?

Ans: Oil Seeds, Food Crops, and Annual Commercial / Annual Horticultural Crops.

Q: What are PMFBY Scheme Registration Dates?

Ans: 31st July and 31st December

Q: What is the Official Website of PMFBY?

Ans: https://pmfby.gov.in/

Q: What is the cut-off date for enrolment under PMFBY?

Ans: Cut-offs for the Kharif season and Rabi season are 15th – 31st July and 15th – 30th December respectively

Q: What are the charges that farmers need to pay to get enrolled under PMFBY?

Ans: No extra fee is charged for enrolment under PMFBY. Enrolment under PMFBY is totally free and farmers need to pay only the farmer’s share of the premium amount.

Q: Saving Account/Jan Dhan Account holder in any Bank is eligible to enroll under PMFBY?

Ans: Yes, all Savings or Jan Dhan Account holding farmers can also participate in the scheme by enrolling through their respective bank branches.

Q: What grievance redressal mechanism is established under PMFBY?

Ans: There are 3 Levels set up for this. A. Primary Level B. District Level Grievance Committee C. State Level Grievance Redressal Committee (SGRC).

Q: What is Prevented Sowing?

Ans: The insured area is protected from the risk of prevented sowing due to adverse weather conditions.

Q: What is Localized Calamity?

Ans: This risk is based on loss due to the occurrence of localized risks affected by hailstorms, landslides, inundation, cloud bursts and natural fire due to lightning affecting isolated farms in the notified area.

Q: What are Post-Harvest Losses?

Ans: the yield loss is assessed for the crops that are harvested and are spread out in the field for drying purposes for a maximum period of 2 weeks (14 days) after harvesting against specific perils like hailstorms, cyclones, cyclonic rains and unseasonal rains.

Related Posts :